Page 20 of 23

Re: Topic Split: Stock Market Watch

Posted: 30 Nov 2021 11:32

by BF004

This morning was a blood bath.

Re: Topic Split: Stock Market Watch

Posted: 10 Dec 2021 09:35

by paco

So, what are the apes saying these days? Everyone still have diamond hands with AMC or is it time to cut bait?

Re: Topic Split: Stock Market Watch

Posted: 10 Dec 2021 10:14

by BF004

paco wrote: ↑10 Dec 2021 09:35

So, what are the apes saying these days? Everyone still have diamond hands with AMC or is it time to cut bait?

I haven't seen any indication of anyone selling. Ortex actually just report the highest short interest on AMC since May a few days back.

Re: Topic Split: Stock Market Watch

Posted: 10 Dec 2021 21:01

by wallyuwl

paco wrote: ↑10 Dec 2021 09:35

So, what are the apes saying these days? Everyone still have diamond hands with AMC or is it time to cut bait?

I sold about a month ago for about $44. Wife pressure, mostly, but I also was tired of seeing "the moon" passing by. I had bought in 20 shares around $20 and 21 at $54.

Re: Topic Split: Stock Market Watch

Posted: 13 Dec 2021 16:29

by Captain_Ben

I haven't sold a share.

I don't think retail is selling, for the most part.

Lot's happening in the market. HF's still have to cover. They have shorted the &%$@ out of it and there isn't any way around it. AMC is an American Corporation with lots of theaters and lots of employees. It's not some BS penny stock that the shorts can cellar box and run out of business. The externalities that loom such as Evergrande, Fed tapering, bad jobs reports, etc. put more pressure on HF's to cover IMO. DOJ just opened a criminal investigation into short selling. Will it affect the AMC play? I don't know. But time is till on my side and they still haven't covered. So I'm holding.

Re: Topic Split: Stock Market Watch

Posted: 14 Dec 2021 08:28

by BF004

Sold off that SNDL I was sitting on to buy some more AMC this morning =)

Re: Topic Split: Stock Market Watch

Posted: 15 Dec 2021 22:26

by BF004

Nice run up AH there, if it holds a nice gap up with a push into morning, might see a lot of recent short getting out very quickly. Hopefully they just short it more and we get some nice FOMO volume with a lot money sitting on the sidelines right now.

Re: Topic Split: Stock Market Watch

Posted: 17 Dec 2021 09:48

by BF004

Got a ton of ground to make up here again, but beautiful open today.

Re: Topic Split: Stock Market Watch

Posted: 17 Dec 2021 11:18

by Captain_Ben

BF004 wrote: ↑14 Dec 2021 08:28

Sold off that SNDL I was sitting on to buy some more AMC this morning =)

Can't fault you for that move.

Rumor has it a good portion of the Reddit crowd is going to stash their AMC gains in Sundial after AMC runs. So you have time to get back in if you want.

Re: Topic Split: Stock Market Watch

Posted: 17 Dec 2021 11:19

by Captain_Ben

BF004 wrote: ↑17 Dec 2021 09:48

Got a ton of ground to make up here again, but beautiful open today.

I want to see what happens in the last hour of trading. I bet it gets shorted back down to around where it opened.

Re: Topic Split: Stock Market Watch

Posted: 17 Dec 2021 11:24

by BF004

Captain_Ben wrote: ↑17 Dec 2021 11:18

BF004 wrote: ↑14 Dec 2021 08:28

Sold off that SNDL I was sitting on to buy some more AMC this morning =)

Can't fault you for that move.

Rumor has it a good portion of the Reddit crowd is going to stash their AMC gains in Sundial after AMC runs. So you have time to get back in if you want.

Looking like a good move so far. AMC under $23 is just stealing.

Still don't have much conviction on SNDL even after digging into it. I do want to get into that industry, just inevitable when it become legalized nationally and should probably see some good 2-3x spikes in all parties. Could see doing more SNDL, like selling the covered calls on that, might also just park some in Tilray and maybe get some YOLO. Although I was a bit surprised to see YOLO not hold any SNDL. I've held YOLO in the past, maybe I could look for another ETF.

Re: Topic Split: Stock Market Watch

Posted: 17 Dec 2021 11:34

by Pckfn23

Let me ask this, are bonds outside of turning 55 even worth investing in? You always hear/read about how bonds are an integral part of a diversified portfolio, but I can't pull the trigger. Right now (last 5-8 years) their RoR is so low it doesn't seem worth it to me (just turning 40). I don't necessarily need a safe investment yet. There is still time to make up losses. I would go with a Bond ETF if I did pull the trigger. Thoughts?

Re: Topic Split: Stock Market Watch

Posted: 17 Dec 2021 11:45

by BF004

Don't do bonds

You can achieve the same concept of diversifying and market protection from getting things like precious metals or crypto. Get Voyager or BlockFi and park your money in USDC, getting 9% interest right now. Rate likely to change in time, just as likely to go up with inflation as down though.

Voyager coming out with a Mastercard debit card and I'm a member of their loyalty program (500+ VGX tokens) so I am gunna get 9.5% interest on my balance and 2% cashback in USDC on every purchase.

https://www.investvoyager.com/debitcard/

But you can get the 9% even without getting the debit card.

I'll see how it is all working out when I get it in a few weeks/months, but I would like that to become our primary savings account and pay all bills possible from that. BlockFi already has a similar card out.

PM me if that confuses or scares you, and I will talk you through it.

Re: Topic Split: Stock Market Watch

Posted: 17 Dec 2021 12:00

by Pckfn23

BF004 wrote: ↑17 Dec 2021 11:45

Don't do bonds

You can achieve the same concept of diversifying and market protection from getting things like precious metals or crypto. Get Voyager or BlockFi and park your money in USDC, getting 9% interest right now. Rate likely to change in time, just as likely to go up with inflation as down though.

That sort of diversification is also the route I was thinking. Invest in different sectors, commodities, and assets. It buffers against loss outside of a recession, but if there is a recession most investments are going to fall anyway. The only reason to go Bonds, in my opinion, is for the lack of risk when you are approaching retirement. That would be the big difference between diversifying with Bonds and say Crypto.

If that sounds off, let me know.

Re: Topic Split: Stock Market Watch

Posted: 17 Dec 2021 12:09

by BF004

Pckfn23 wrote: ↑17 Dec 2021 12:00

BF004 wrote: ↑17 Dec 2021 11:45

Don't do bonds

You can achieve the same concept of diversifying and market protection from getting things like precious metals or crypto. Get Voyager or BlockFi and park your money in USDC, getting 9% interest right now. Rate likely to change in time, just as likely to go up with inflation as down though.

That sort of diversification is also the route I was thinking. Invest in different sectors and commodities. It buffers against loss outside of a recession, but if there is a recession most investments are going to fall anyway. The only reason to go Bonds, in my opinion, is for the lack of risk when you are approaching retirement. That would be the big difference between diversifying with Bonds and say Crypto.

If that sounds off, let me know.

Well USDC is 100% tied to the US Dollar, so I guess yes that will crash with a bad economy and lose its value in an inflationary economy without that 9% interest, but that is far superior to bonds. But against that recession, I have been sitting on gold, silver and platinum in an effort to diversify and get a bounce against recession/inflation. It has been painful as it hasn't moved and maybe gone down in the past few years while crypto and stocks have just been ripping like nuts.

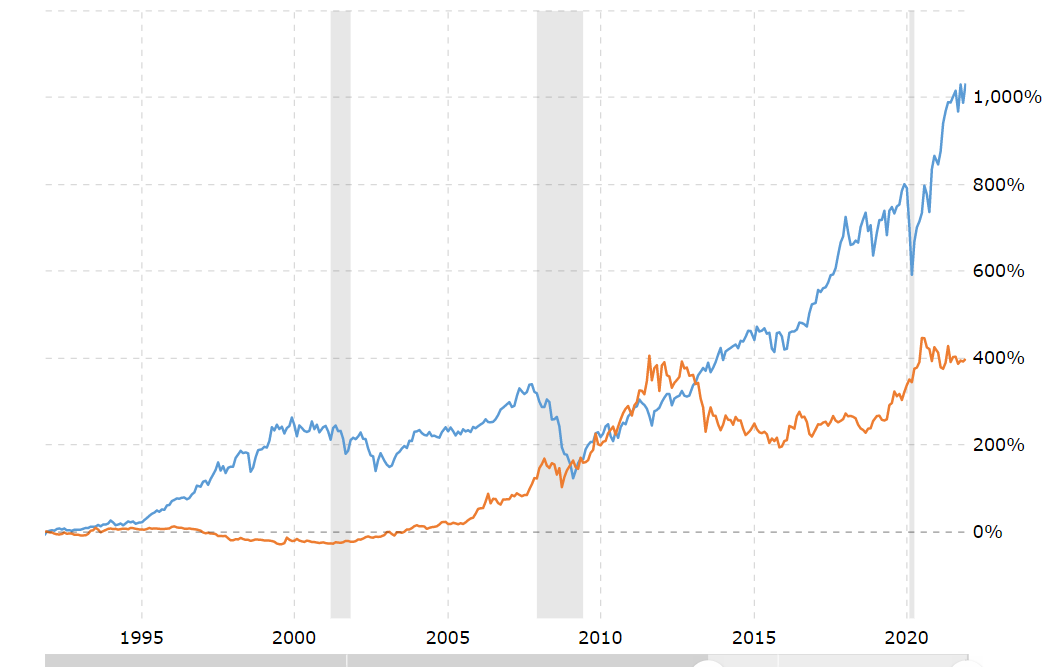

So all on your risk tolerance. IF you are looking for a strong hedge against inflation and recession, metals are your best bet. Much like you are diversifying your portfolio, diversify your metals too. Silver is harder to hold, if you get a few $1,000 dollars worth, it is just physically gonna take up a lot of space an weigh a lot, lol. Safe deposit box and average size in home safe isn't gunna hold it all. But in a good economy, you are gunna lose a lot of money, IMO. Kind of think of it like playing insurance premiums against a recession, gunna lose out money, but are protecting yourself. But even last recesssion which was awful, gold barely surpassed the SP500 and only for a brief time. Gold is orange, SP500 is blue.

- image.png (58.11 KiB) Viewed 10230 times

For a long play, 5-15 years, I think crypto is the best bet there is right now. It isn't just fun replacement for gold, it is the block chain technology that is finding an ever increasing real world uses in nearly every major industry. The more that gets integrated, the more its just gunna have value.

Just get them all.

And don't forgot about real estate either. Best, safest way to gain some passive income.

Re: Topic Split: Stock Market Watch

Posted: 17 Dec 2021 12:55

by Pckfn23

Real estate scares me right now only because these housing prices can not continue to go up. They are ridiculous!

Re: Topic Split: Stock Market Watch

Posted: 17 Dec 2021 13:56

by BF004

Pckfn23 wrote: ↑17 Dec 2021 12:55

Real estate scares me right now only because these housing prices can not continue to go up. They are ridiculous!

Anything is possible with 6-7% inflation.

But is about diversification too, just a small piece. You don't need to own land. You can find local/small commercial or residential investments funds that will maybe own like 10-50 properties and do all the hard accounting work for you.

Just don't sit on your money and do nothing.

Re: Topic Split: Stock Market Watch

Posted: 20 Dec 2021 09:30

by BF004

If you got conviction and you know your trade, you keep pumping those dips!!

Re: Topic Split: Stock Market Watch

Posted: 20 Dec 2021 09:32

by BF004

BF004 wrote: ↑15 Dec 2021 22:26

Recent price move had nothing to do with any shorts getting out either.

Still jacked on the SI

Re: Topic Split: Stock Market Watch

Posted: 22 Dec 2021 08:01

by go pak go

Here is my current thoughts and strategy on investing:

1. Equities - think they are overvalued. I like liquidity right now and have limits in but the market needs to drop more. I will slowly buy in rather than quickly buy in like I did from November 2020 - March 2021 (stupid me). My current guess is Growth Stocks will still fall the hardest first and those will be the first ones I buy more of. Eventually though Growth Stocks will start to climb and your Value and S&P 500 stocks will start either drop or not climb as fast as Growth. When that happens, I will start buying those conventional equities again. I just can't stomach buying the Value and S&P stocks right now. Usually really good years in a sector in the market is followed by a poor year the following year.

2. Crypto - Crypto is my new "liquid" fund. I am using Celsius to park StableCoin which earns generally 10%. This is where I park relatively liquid dollars (3 months or longer) to avoid parking too much money in a savings account. Stablecoin is tied to dollar so the value is constant. The only real risk is the account is not FDIC insured and likely would suffer if crypto completely loses value.

3. Real Estate - I hate real estate right now. I hate it so much. Real Estate prices are outpacing rent prices. Real Estate was a no brainer to buy from 2008 - 2016. The cash flows on rents worked. They don't anymore. CAP rates are lowered and I just hate buying real estate when cash flow isn't there. I expect real estate to be a better buy once mortgage rates start climbing again.

You can achieve the same concept of diversifying and market protection from getting things like precious metals or crypto. Get Voyager or BlockFi and park your money in USDC, getting 9% interest right now. Rate likely to change in time, just as likely to go up with inflation as down though.

You can achieve the same concept of diversifying and market protection from getting things like precious metals or crypto. Get Voyager or BlockFi and park your money in USDC, getting 9% interest right now. Rate likely to change in time, just as likely to go up with inflation as down though.